Year in Review - VC 2022 - Trends to Watch in 2023

From Record High VC Activity in 2021 to Decade Lows in 2022

As the curtains close on 2022, the VC (Venture Capital) industry has been turned upside down compared to its record year of 2021. The times of monetary easing during the peak pandemic era where VC represented a fruitful market is over. A time where SaaS companies annual recurring revenues (ARR) reached all-time high multiples of 17x. The days of burning through $10 million of cash each month and reporting 6 figures in annual sales. The market is entering a time period where profitability and lowering cost take priority over ultra high growth. Venture capital and private equity (PE) firms reduced the pace of their investments towards the 2nd half of 2022, signaling what's to come in the first half of 2023.

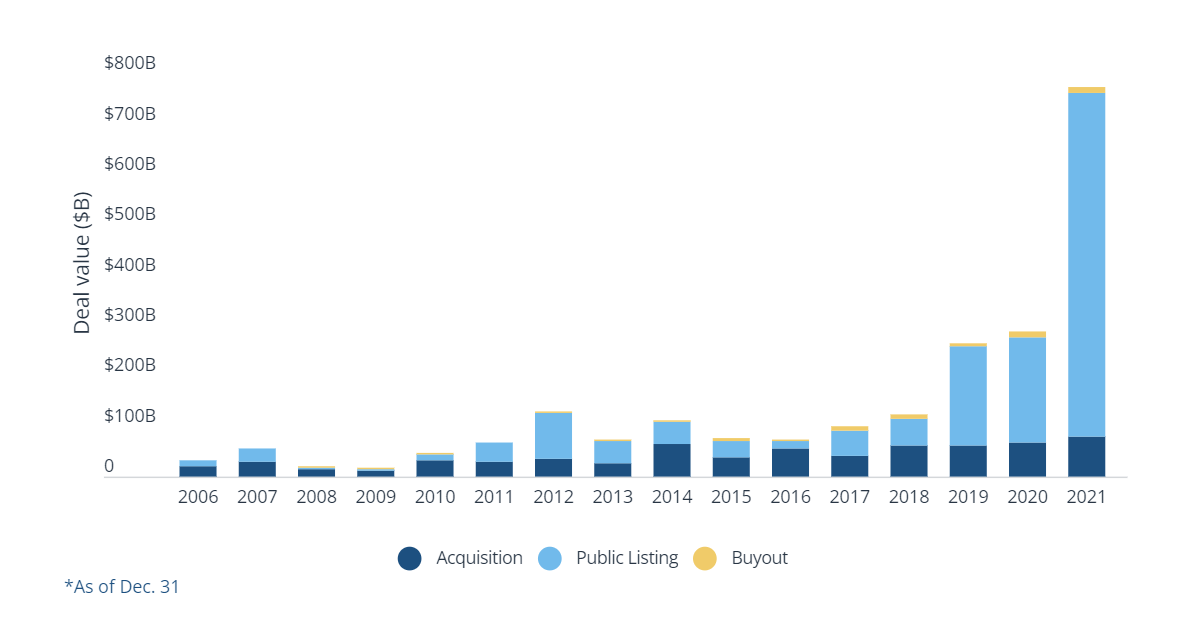

As mentioned above, 2021 was a tough year to follow on. U.S. VC-backed companies raised over $330 billion in 2021, doubling the previous record of $166.6 billion raised in 2020. VC was one of the best performing private asset classes in 2021, with attractive returns leading nontraditional investors such as mutual funds and sovereign wealth funds to participate. The most notable outlier is the spike in exit’s such as initial public offerings (IPO), direct listings, mergers & acquisitions (M&A), and buyouts. This included 296 VC-backed public listings that represented 114.5% YoY growth, led by big names such as Coinbase, Roblox, Rivian, and Robinhood. Lastly, VC firms raised (at the time) a record $128.3 billion in 2021, a 47.5% YoY growth from 2020. Acronyms like SPAC (Special Purpose Acquisition Company) and NFT (Non-Fungible Token) attracted VC attention as a quick get rich scheme.

Pitchbook - 2021 VC-Backed Exits

Overview of 2022

Deal Count

Deal count activity in 2022 came in at 15,852, down 14% YoY from 18,521 in 2021. Deal value had also fallen off a cliff with $238.3 billion recorded, down 30% YoY from $344.7 billion in 2021. Different stages of VC have fared better than others such as angel and seed stages remaining resilient with $21 billion invested across deals. A lot of this is due in part from micro funds and nontraditional investors participating in the 2021 gains poured over into 2022. This stage will begin to feel pain, should economic activity begin to trend down and decrease deal activity. Late stage deals have been hit the hardest, with rising interest rates impacting their future cash flows and valuations. 2022 deal value came in at $93.7 billion, a YoY decrease of 55.8% from $146 billion in 2022. Many of these late stage companies are being hit with barriers such as exiting through the public markets that have gone frozen since the SPAC mania of 2021 and private markets going back to lengthier, more traditional exit timelines.

Exits

Screeching to a halt has been exit activity in 2022, most notably in Q4 with only $5.2 billion of capital exited. Overall, 2022 recorded $71.4 billion in exit value, a 955% decline from 2021 and its exit value of $753.2 billion. The first time since 2016 that exit value has dropped below $100 billion. As mentioned above, the low rate of public listings from VC-backed companies continued its downward trend with only 14 public listings happening in Q4 2022. As interest rates continue to rise and an impending global recession is on its way, institutional investors have lost their appetite to take part in public offerings. Leveraged buyouts (LBO) have also declined in 2022, due to the increasing cost of debt to finance transactions that were widely available in 2021. Acquisitions have also cooled off, even with the benefits that come from gaining new customers or reducing cost. Volatile economic conditions have made it harder for consumers to keep up with the purchasing spree they had in the last 2 years.

Pitchbook - 2022 VC-Backed Exits

Fundraising

Ending off with optimism, VC’s closed out the year raising $162.2 billion across 769 funds, setting an annual record of capital raised and 5% YoY increases from $154 billion raised in 2021. A majority of the raising can be attributable to momentum going into 2021 when limited partners (LP) were opportunistic in VC activity. Also, began soliciting LP interest before the economic downturn due to inflation and interest rates began to take hold. Of the capital raised, a large amount was directed into larger-sized funds, led by more experienced fund managers who have experienced economic hardships. LP’s are less willing to gamble on young investors with no track record or go through costly diligence on new firms. 72.6% of capital raised in 2022 found its way to traditional areas like the Bay Area and New York. Other locations have been on the rise in middle-market ecosystems such as Denver, Nashville, and Philadelphia, where capital raised has been on par with 2021 figures.

Trends

Artificial Intelligence

Generative AI this, generative AI that, how about you generate some revenue. We’ve seen hype and bubbles around new technologies since the dawn of time but recently with the dot-com era and crypto. Don’t get me wrong, AI has the potential to help with the following aspects of our life:

Healthcare: AI can help diagnose diseases, develop personalized treatment plans, and improve medical imaging.

Education: AI can provide personalized learning experiences and help educators with data analysis and student assessment.

Business: AI can automate repetitive tasks, enhance decision-making and improve customer experiences.

Transportation: AI can optimize routes, improve safety and reduce traffic congestion.

Environment: AI can help monitor and protect the environment, reduce waste and increase energy efficiency.

The industry has also seen notable acquisitions such as Microsoft acquiring OpenAI and Google's acquisition of Anthropic. Expect to see venture activity increasing in this space as the year goes on.

Climate Tech

The passing of the Inflation Reduction Act (IRA) back in August 2022 has seen investment inflows surge into climate tech related companies as increasing acceptance of the need to manage climate change, and pledges to reduce emissions, interest in climate tech is climbing. The Bill provides close to $370 billion in broad support for climate technologies. Expect to see valuations and investments unaffected by the economic downturn we are to potentially face.

Final Thoughts

Overall, expect VC’s to deploy the dry powder of cash that was raised last year. More startups will begin to shift their businesses to profitability instead of top line growth. For the economy, the federal reserve continues to hike rates, inflation has continued to come down, and unemployment is at a 64 year low which puts everything at a weird spot. But, with all markets, what goes up, must come down.

By: Joseph Roberts, Principal at Hillside Ventures