Mason Kolean, Zachary Will, Amanda McMahon

Backed by the macroeconomic environment

Given the current macroeconomic environment, raising capital in 2023 is an arduous journey for founders. Venture Capital firms are hardwired to focus on both the start-up’s market opportunity, and their defensible moat, which is their durable ability to maintain a competitive advantage and keep their competition from copying their value proposition(s). VC’s are able to spearhead the risk associated with an investment by validating the product, evaluating their revenue stream, and putting their trust in a strong management team. In addition to these key factors, VCs are seeking to identify a combination of excellence and potential. They are on the lookout for an innovative and promising solution found in a compelling market, which is a combination that is currently witnessing a shortage.

Evidently, the global venture dollar volume has aggressively declined in all funding stages, spanning from seed to growth, during the last three quarters of 2022. Prior to this recent decline, the volume had been increasing consecutively for seven quarters. Leading to the point that today, founders are hearing “no” significantly more than “yes” from investors.

Despite this; Star-studded opportunities have presented themselves in the past months granting Hillside Ventures the chance to continue underwriting the future and stacking our portfolio with extraordinary businesses. Our once-overlooked $25K check size has been looking much more appetizing for founders and their start-ups, not to mention the non-fungible assets at UConn that come with the Hillside investments.

These challenges have presented Hillside Ventures with opportunities to hop on the phone with companies that wouldn’t otherwise take a call. Our response rate and deal inflow are at an all-time high. Expanding deal flow has allowed us to review more pitch decks and concentrate our diligence efforts. We are focusing on inhabiting more of a selective approach, given the unknown future and risk intake. We have increased diligence efforts by almost doubling our team in the past year and utilizing our university’s experts and fund advisors. Matched with our team’s market perspective and previous investing knowledge, we aim to achieve holistic well-informed decisions to take our portfolio to the next level.

Venture Capital firms aren’t writing checks at the same pace as they were in 2021 and likely never will again, however, start-ups still need the funding. The slowed capital deployment rate stems from the capital going into the funds from outside investors. The flow of funds from investors to the fund and to the start-up itself is a trickle-down effect leaving these companies running on tight budgets, and smaller burn rate flexibility, as well as restricting innovation and opportunity that is usually sparked by VC dollars. This results in an increase in discounted and bridge rounds as companies seek runway.

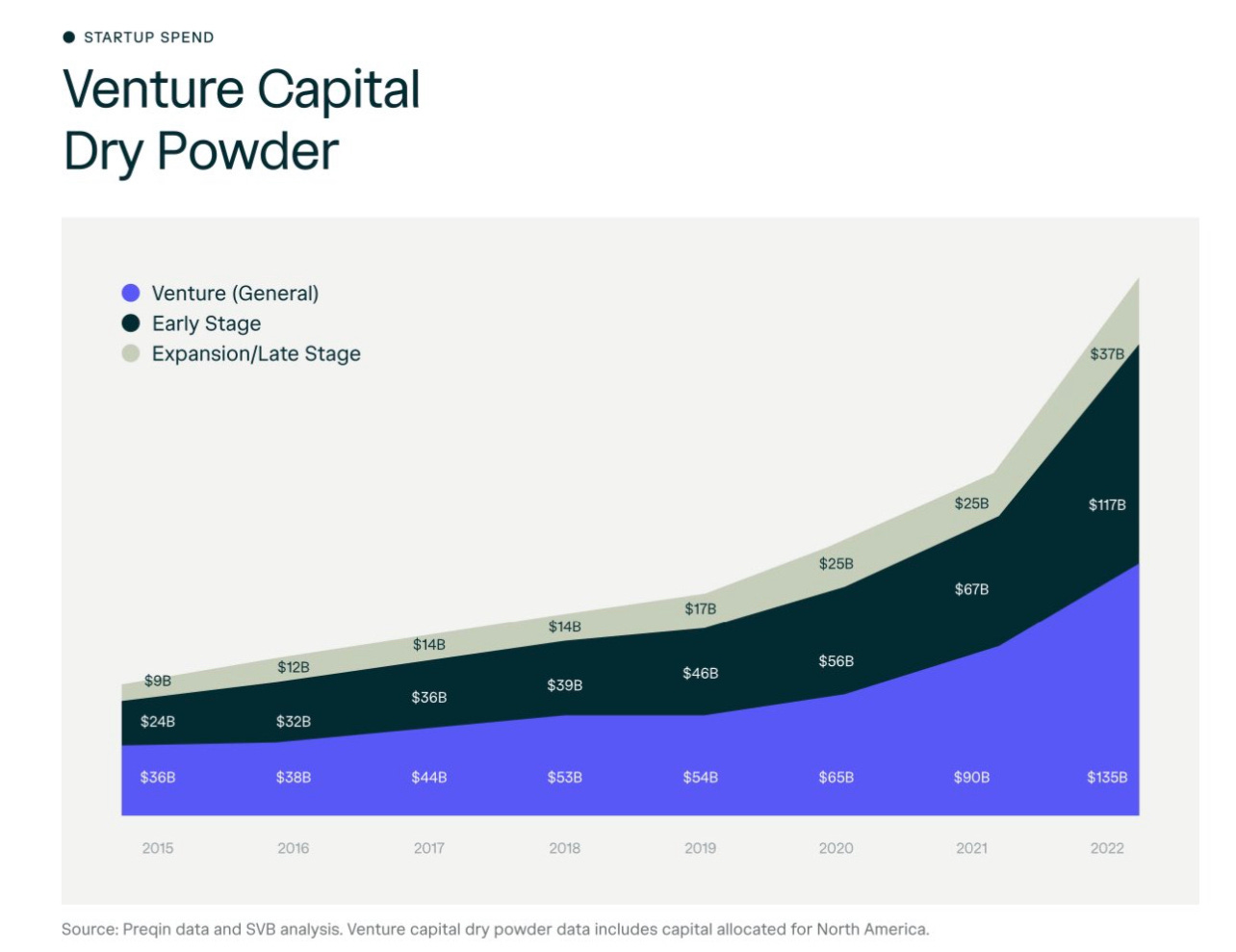

Going forward; whether it be discounted rounds or more structured offerings, venture dry powder, or the amount of unused and readily available capital, must decrease. As investor sentiment increases over the next 12-36 months, capital deployment will begin to increase as they put LP’s capital to work.

The future is reliant on the backing of venture capital dollars. The next few quarters will be exciting to follow and provide a great picture of the toughness of both venture capital firms and founders. We at Hillside Ventures will continue our holistic approach to support the future of the Sustainability, InsurTech, and EdTech industries.

Sources:

https://news.crunchbase.com/venture/global-vc-funding-pullback-q3-2022-monthly-recap/

https://www.wsj.com/articles/venture-fundraising-hits-nine-year-low-c2b4774