An Analysis of the Biotech Market

By Kwame Kwarteng

Introduction:

The biotechnology (biotech) industry is a dynamic and multifaceted sector that leverages biological processes and living organisms to develop innovative products and solutions across diverse fields. It encompasses four primary segments: medical biotechnology (focusing on healthcare advancements), agricultural biotechnology (aiming to improve crop yields and food production), industrial biotechnology (creating biofuels and industrial enzymes), and environmental biotechnology (addressing environmental issues). Throughout its history, biotechnology has rapidly evolved, with the advent of revolutionary technologies like gene editing and recombinant DNA techniques, leading to breakthroughs in medicine, agriculture, and environmental conservation. Ethical and regulatory considerations are integral to the industry, and governments and organizations worldwide establish guidelines to ensure responsible and safe practices. The biotech industry is a driving force behind economic growth and innovation, with a promising future as it continues to address pressing global challenges and shape the world through cutting-edge science and technology.

History/Background:

The history of biotechnology is a fascinating journey through the development of scientific knowledge, technological innovations, and the practical application of biological principles. Here's a brief overview of key milestones and events in the history of biotech:

Ancient Roots: Biotechnology has ancient roots, with humans using biological processes for thousands of years. Early examples include the fermentation of grapes to make wine and the use of microorganisms to leaven bread. These processes involved the controlled use of living organisms for specific purposes.

19th Century: The 19th century saw significant progress in microbiology with the work of scientists like Louis Pasteur and Robert Koch. Their discoveries laid the foundation for understanding the role of microorganisms in fermentation and disease, and their techniques contributed to the development of bioprocessing.

20th Century: The 20th century marked a turning point in biotechnology. In 1953, James Watson and Francis Crick discovered the structure of DNA, providing a fundamental understanding of genetic material. The development of techniques like polymerase chain reaction (PCR) and DNA sequencing revolutionized genetic research.

Recombinant DNA Technology: In the 1970s, the invention of recombinant DNA technology by Paul Berg allowed scientists to manipulate DNA, leading to the creation of genetically engineered organisms. This breakthrough opened the door to the biotech industry as we know it today.

Medical Biotechnology: The 1980s saw the emergence of medical biotechnology, with the production of recombinant insulin and other biopharmaceuticals. This revolutionized the treatment of various diseases and disorders, marking a significant step in the development of personalized medicine.

Agricultural Biotechnology: In the 1990s, the commercialization of genetically modified (GM) crops, such as herbicide-resistant soybeans and insect-resistant corn, transformed agriculture. GM crops have since become a critical part of global food production.

Human Genome Project: The Human Genome Project, initiated in 1990, aimed to map and sequence the entire human genome. Its successful completion in 2003 opened up new possibilities in personalized medicine, genetic testing, and understanding genetic contributions to diseases.

CRISPR-Cas9: In the 21st century, the development of the CRISPR-Cas9 gene editing technology has revolutionized genetic engineering. It offers precise and efficient tools for modifying the DNA of living organisms and has applications in medicine, agriculture, and more.

Advanced Therapies: Recent years have seen the emergence of advanced therapies, including gene therapy and immunotherapy, which hold great promise for treating diseases like cancer and genetic disorders.

Environmental and Industrial Biotechnology is also making significant contributions to environmental sustainability and industrial processes, with applications in bioremediation, biofuels, and sustainable materials.

Throughout its history, biotechnology has continually evolved and expanded its applications, from basic scientific discoveries to commercial products that impact various industries and improve human life. It remains a dynamic and rapidly developing field with the potential to address some of the most pressing global challenges.

Market Dynamics:

The global biotechnology market size was estimated at USD 1.37 trillion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.96% from 2023 to 2030. The market is driven by strong government support through initiatives aimed at modernization of regulatory framework, improvements in approval processes & reimbursement policies, as well as standardization of clinical studies. Growing foothold of personalized medicine and an increasing number of orphan drug formulations are opening new avenues for biotechnology applications and are driving the influx of emerging and innovative biotechnology companies, further boosting the market revenue.

For many industries across the United States and the world COVID – 19 proved to be an incredible hinderance to expected progress, but for the Biotech industry this was in fact the complete opposite. The industry saw an incredible boom that in many ways helped the world exit that grueling and scary time period. The COVID-19 pandemic positively impacted the biotechnology market by propelling a rise in opportunities and advancements for drug development and manufacturing of vaccines for the disease. For instance, in 2021, over 11 billion doses of COVID-19 vaccine were produced globally, resulting in vaccination of about half of the world’s population within a year. Furthermore, the success of mRNA vaccines and accelerated approval processes have led to a surge in vaccine-related revenues, as evident by a combined revenue generation of around USD 31 billion in 2021 from Moderna, Pfizer/BioNTech, and Johnson & Johnson vaccines.

The market is also driven by the presence of strong clinical trial pipeline and funding opportunities available in tissue engineering and regeneration technologies. As per the Alliance for Regenerative Medicine, companies developing cell and gene therapies raised over USD 23.1 billion investments globally in 2021, an increase of about 16% over 2020’s total of USD 19.9 billion. Clinical success of leading gene therapy players in 2021, such as promising results from an in vivo CRISPR treatment for transthyretin amyloidosis, developed by Intellia Therapeutics and Regeneron, are significantly affecting the market growth.

Technology Insights:

Due to the increasing use of sophisticated DNA sequencing techniques and the decrease in sequencing prices, DNA sequencing accounted for a sizeable portion of the market in 2022 (16.51%). Applications of sequencing to better understand diseases have increased because to government support for genetic research. For example, the University of Pittsburgh Graduate School of Public Health and Washington University School of Medicine in St. Louis were given a USD 10.7 million NIH grant in May 2021 to investigate the genetic basis of Alzheimer's disease.

Because of the rise in approvals for nanomedicine and the introduction of cutting-edge technologies, nanobiotechnology is predicted to grow at a CAGR of 14.87% between 2023 and 2030. Applications of theranostics nanoparticles, for example, have gained momentum in order to facilitate rapid diagnosis and personalized therapy choices for several illnesses simultaneously. The low toxicity, smaller size, and chemical adaptability of nanoparticles have shown to be advantageous in addressing the drawbacks of using traditional methods for the administration of generic drugs. Additionally, a large portion of the market was occupied by tissue engineering and regenerative medicine as a result of public and private expenditures in the field, high healthcare spending, and a sizable number of established and up-and-coming firms.

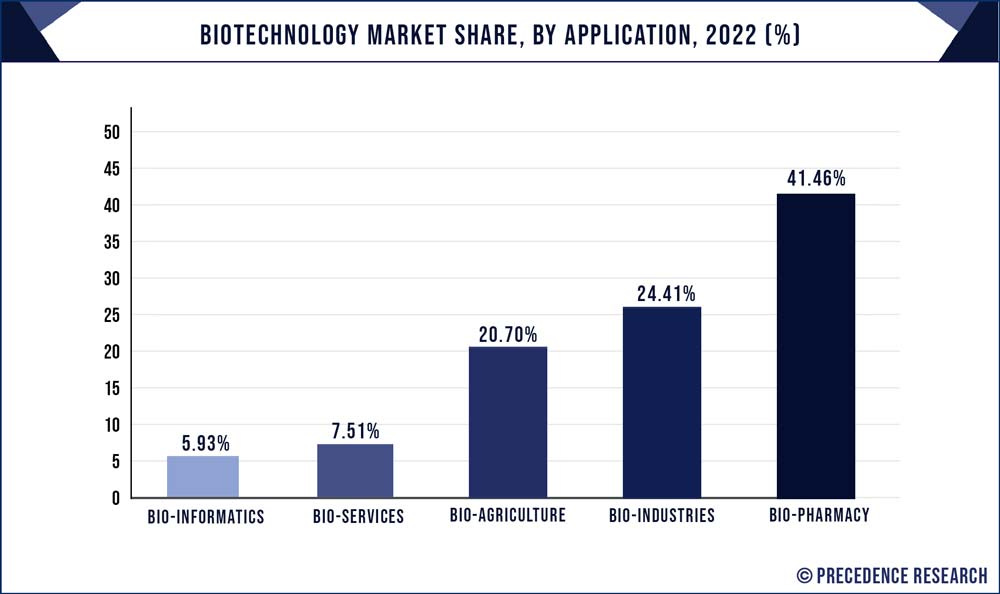

Application Insights:

In 2022, the health application segment held the highest proportion of 50.69%. The bio-industrial sector's technological advancements, rising agri-biotech & bioservices availability, and rising disease burden are anticipated to propel the segment's expansion. Significant developments in the domains of artificial intelligence (AI), machine learning, and big data are also driving the expansion of this segment. These developments are anticipated to boost the use of bioinformatics applications, particularly in the food and beverage and other industries.

Furthermore, it is projected that partnerships and cooperative activities focused on the creation and marketing of novel treatment platforms and compounds will propel market expansion. For example, in January 2021, Novartis and Alnylam worked together to investigate the potential of using the latter's siRNA technology to develop tailored therapies for the restoration of liver function. Similarly, AstraZeneca and VaxEquity partnered in September 2021 to develop and market a self-amplifying RNA therapies platform to investigate new therapeutic initiatives. Moreover, during the projected period, expanding applications of precision medicine and growing demand for biosimilars are anticipated to fuel sector expansion.

Regional Insights

With a 41.63% share, North America held the most share in 2022. Several variables, including the existence of major competitors, significant R&D activity, and high healthcare expenditure, are contributing to the growth of the regional market. The region is seeing a rapid uptake of life sciences technologies due to the strong penetration of platforms based on genomics, proteomics, and cell biology. Additionally, it is anticipated that the region's market will increase favorably due to the rise in the prevalence of chronic diseases and the growing use of personalized medicine applications for the treatment of life-threatening illnesses.

Asia Pacific is expected to expand at the fastest growth rate of 18.17% from 2023 to 2030. Other studies show that the rate of for this same time is 13.7%, so believe an estimate between these two figures is fair The expansion of the Asia-Pacific biotechnology market is being aided by favorable government laws, clinical trial services, and improved healthcare infrastructure. In addition, global market giants are actively collaborating with regional businesses to hasten the expansion of the biotechnology sector.

Key Companies and Market Insights

The most innovative approach to addressing the COVID-19 pandemic's issues is to use biotechnology goods. A strong pipeline of businesses in this sector has enabled them to continue the competitive and dynamic market in 2022.These companies' geographic expansion, strategic alliances and partnerships, mergers, and acquisitions are driving the market's expansion. For example, Anima Biotech and AbbVie joined together in January 2023 to expedite the creation of innovative mRNA biology modulators for the treatment of diverse immunology and cancer targets. Global biotechnology market leaders include some of the following:

AstraZeneca

Gilead Sciences, Inc.

Bristol-Myers Squibb

Sanofi

Biogen

Abbott Laboratories

Pfizer, Inc.

Amgen Inc.

Novo Nordisk A/S

Merck KGaA

Johnson & Johnson Services, Inc.

Novartis AG

F. Hoffmann-La Roche Ltd.

Lonza

Final Thoughts

Nevertheless, the dynamic landscape of the biotechnology market continues to unfold, promising groundbreaking innovations and transformative solutions to global challenges. As advancements in research, investment, and collaboration propel the industry forward, the potential for addressing critical health, environmental, and agricultural issues remain unparalleled. The biotechnology market stands not only as a driver of scientific progress but also as a beacon of hope for a sustainable and healthier future, where the fusion of biology and technology continues to shape the trajectory of progress on a global scale.